Bitmine has 3,040,483 staked ETH, representing $6.1 billion at $1,998 per ETH; MAVAN staking solution on track to launch Q1 2026

Bitmine now owns 3.62% of the ETH token supply, over 72% of the way to the ‘Alchemy of 5%’ in just 7 months

Bitmine recently closed on initial $200 million investment into Beast Industries

Bitmine Crypto + Total Cash Holdings + “Moonshots” total $9.6 billion, including 4.371 million ETH tokens, total cash of $670 million, and other crypto holdings

Bitmine leads crypto treasury peers by both the velocity of raising crypto NAV per share and by the high trading liquidity of BMNR stock

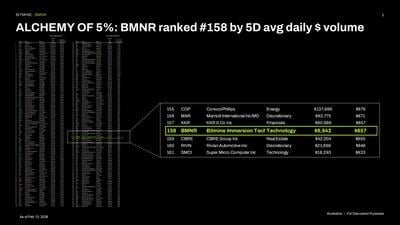

Bitmine is the 158th most traded stock in the US, trading $0.9 billion per day (5-day avg)

Bitmine remains supported by a premier group of institutional investors including ARK’s Cathie Wood, MOZAYYX, Founders Fund, Bill Miller III, Pantera, Kraken, DCG, Galaxy Digital and personal investor Thomas “Tom” Lee to support Bitmine’s goal of acquiring 5% of ETH

LAS VEGAS, Feb. 17, 2026 /PRNewswire/ — (NYSE AMERICAN: BMNR) Bitmine Immersion Technologies, Inc. (“Bitmine” or the “Company”) a Bitcoin and Ethereum Network company with a focus on the accumulation of crypto for long term investment, today announced Bitmine crypto + total cash + “moonshots” holdings totaling $9.6 billion.

As of February 16th, 2026 at 5:00pm ET, the Company’s crypto holdings are comprised of 4,371,497 ETH at $1,998 per ETH (NASDAQ: COIN), 193 Bitcoin (BTC), $200 million stake in Beast Industries, $17 million stake in Eightco Holdings (NASDAQ: ORBS) (“moonshots”) and total cash of $670 million. Bitmine’s ETH holdings are 3.62% of the ETH supply (of 120.7 million ETH).

“After spending the past week at Consensus Hong Kong, one of the largest global gatherings in crypto, we came away with a growing conviction that 2026 will be a defining year for Ethereum. We see strengthening product-market fit emerging on the back of three long-duration secular drivers: (i) Wall Street via tokenization/privacy on Ethereum; (ii) AI and AI-agents using Ethereum for both collecting payments as well as verification and (iii) creators leaning towards ‘proof of human’ and other standards running on Ethereum L2 (Worldchain, etc). There were many panel discussions and presentations around these 3 topics, and it is evident that Ethereum is well positioned to garner significant share, given its neutrality and 100% uptime and reliability,” said Thomas “Tom” Lee, Chairman of Bitmine.

Mr. Lee’s latest Chairman’s message is his keynote given at Consensus HK, and he speaks about these 3 future growth drivers for ETH usage as well as the drivers for Bitmine growth initiatives. The link to his message is here.

“Investor sentiment and enthusiasm, by contrast, are rock bottom, reminding us of the forlornness and dejection seen at the November 2022 lows and depths of 2018 crypto winter. During 2018 and 2022, there were many high profile failures of large players (FTX, 3 arrows in 2022) while 2025-2026 has not seen such large-scale debacles. Rather, it seems like crypto has remained weak since the ‘price shock’ and massive deleveraging seen on October 10th. For us at Bitmine, we cannot control the price of Ethereum, and the company is acquiring ETH regardless of price trend, as the long-term outlook for Ethereum remains outstanding. Hence, we continue to buy ETH even as crypto moves through this ‘mini-winter,'” said Lee.

“In the past week, we acquired 45,759 ETH,” continued Lee. “Bitmine has been steadily buying Ethereum, as we view this pullback as attractive, given the strengthening fundamentals. In our view, the price of ETH is not reflective of the high utility of ETH and its role as the future of finance.”

As of February 16, 2026, Bitmine total staked ETH stands at 3,040,483 ($6.1 billion at $1,998 per ETH). “Bitmine has staked more ETH than other entities in the world. At scale (when Bitmine’s ETH is fully staked by MAVAN and its staking partners), the ETH staking rewards is $252 million annually (using 2.89% 7-day BMNR yield),” stated Lee.

“Annualized staking revenues are now $176 million. And this 3.0 million ETH is about 69% of the 4.37 million ETH held by Bitmine. The CESR (Composite Ethereum Staking Rate, administered by Quatrefoil) is 2.84%, while Bitmine’s own staking operations generated a 7-day yield of 2.89% (annualized). We continue to make progress on our staking solution known as The Made in America VAlidator Network (MAVAN). This will be the ‘best-in-class’ solution offering secure staking infrastructure and will be deployed in early calendar 2026. Bitmine is currently working with 3 staking providers as the Company moves towards unveiling MAVAN in 2026,” continued Lee.

Bitmine crypto holding reigns as the #1 Ethereum treasury and #2 global treasury, behind Strategy Inc. (NASDAQ: MSTR), which owns 714,644 BTC valued at $49 billion. Bitmine remains the largest ETH treasury in the world.

Bitmine is one of the most widely traded stocks in the US. According to data from Fundstrat, the stock has traded average daily dollar volume of $0.9 billion (5-day average, as of February 13, 2026), ranking #158 in the US, behind KKR (rank #157) and ahead of CBRE (rank #159) among 5,704 US-listed stocks (statista.com and Fundstrat research).

The GENIUS Act and Securities and Exchange Commission’s (“the SEC”) Project Crypto are as transformational to financial services in 2025 as US action on August 15, 1971 ending Bretton Woods and the USD on the gold standard 54 years ago. This 1971 event was the catalyst for the modernization of Wall Street, creating the iconic Wall Street titans and financial and payment rails of today. These proved to be better investments than gold.

The Chairman’s message can be found here:

https://www.Bitminetech.io/chairmans-message

The Fiscal Full Year 2025 Earnings presentation and corporate presentation can be found here: https://Bitminetech.io/investor-relations/

To stay informed, please sign up at: https://Bitminetech.io/contact-us/

About Bitmine

Bitmine (NYSE AMERICAN: BMNR) is the leading Ethereum Treasury company in the world, implementing an innovative digital asset strategy for institutional investors and public market participants. Guided by its philosophy of “the alchemy of 5%,” the Company is committed to ETH as its primary treasury reserve asset, leveraging native protocol-level activities including staking and decentralized finance mechanisms. The Company will launch MAVAN (Made-in America VAlidator Network), a dedicated staking infrastructure for Bitmine assets, in Q1 of 2026.

For additional details, follow on X:

Forward Looking Statements

This press release contains statements that constitute “forward-looking statements.” The statements in this press release that are not purely historical are forward-looking statements which involve risks and uncertainties. This document specifically contains forward-looking statements regarding progress and achievement of the Company’s goals regarding ETH acquisition and staking, the long-term value of Ethereum, continued growth and advancement of the Company’s Ethereum treasury strategy and the applicable benefits to the Company. In evaluating these forward-looking statements, you should consider various factors, including Bitmine’s ability to keep pace with new technology and changing market needs; Bitmine’s ability to finance its current business, Ethereum treasury operations and proposed future business; the competitive environment of Bitmine’s business; and the future value of Bitcoin and Ethereum. Actual future performance outcomes and results may differ materially from those expressed in forward-looking statements. Forward-looking statements are subject to numerous conditions, many of which are beyond Bitmine’s control, including those set forth in the Risk Factors section of Bitmine’s Form 10-K filed with the SEC on November 21, 2025, as well as all other SEC filings, as amended or updated from time to time. Copies of Bitmine’s filings with the SEC are available on the SEC’s website at www.sec.gov. Bitmine undertakes no obligation to update these statements for revisions or changes after the date of this release, except as required by law.