With 4 million users in 17 countries and 35 billion euros in assets, Trade Republic is a neobank specializing in online stock brokerage, but not only that: it also offers savings. In less than 10 years, the platform has made a name for itself on the European market, thanks to an intuitive application, a clear website and innovative investment solutions. Trade Republic is now valued at over 7 billion euros.

| Category | Details |

| Services | – Investing in equities, ETFs, cryptocurrencies, bonds, derivatives – 4% annual return on liquid assets – Programmed investment plan – Fractional investment – Securities account |

| Position in cryptos | Offers over 50 cryptocurrencies with fractional purchase possible. Transparency on fees and accessibility for beginners. |

| Pricing | Very low fees: €1 per order, no fees on dividends received, programmed investment plan with no fees. Fixed fees and no hidden charges. |

| Mobile app | Intuitive app available on App Store and Google Play. Enables easy transactions, real-time notifications and remote investment management. |

| Bank card | Trade Republic Visa bank card with Saveback functionality (1% invested for each payment). |

| Advantages | – Low brokerage fees – Simple, streamlined user interface – Wide range of financial products – Security of funds and data – Possibility of placing orders outside market hours |

| Registration process | Fast and simple via mobile application. Includes identity verification and initial deposit. |

| Customer service | Available via mobile app, email, website, social networks. |

| Users and reviews | Rating of 3.8/5 on Trustpilot with over 18,000 reviews. |

Presentation of Trade Republic and positioning in the banking sector

Founded in 2015 in Munich by Christian Hecker, Thomas Pischke and Marco Cancellieri, Trade Republic is a German fintech (startup that combines finance and technology) that offers a mobile app and website for investing in the stock market.

It is present in countries such as Germany, Austria, France (since 2021), Spain, Italy, the Netherlands, Belgium, Luxembourg and Greece. With it, you can invest in shares and ETFs (exchange-traded funds), cryptocurrencies, corporate or government bonds and derivatives with just €1. It also guarantees you a 4% annual return on your cash (interest is calculated monthly).

Trade Republic offers extremely competitive pricing, with very low fixed fees and no hidden charges. This makes it one of the cheapest brokers on the market, particularly advantageous for large investments. With its large number of users and extensive portfolio, the company has become a major player in individual savings in Europe.

In 2023, Trade Republic obtained a banking license from the ECB, enabling it to offer more investment and savings products in the future.

Trade Republic features

Trade Republic is supervised by BaFin, the German financial supervisory authority, and the German Central Bank (Bundesbank), ensuring a strict and secure regulatory framework for users. The company is also registered with the AMF (Autorité des marchés financiers) in France.

With the licenses it holds and the services it offers, Trade Republic can be considered a bank in its own right. For the time being, however, the company’s directors do not wish to offer traditional banking services such as mortgages or Livret A savings accounts. They prefer to concentrate on savings and investment products.

Trade Republic enables the purchase of over 9,500 shares and around 700 ETFs, as well as crypto-currencies. The neobank mainly targets first-time investors and those wishing to set up passive management through free programmed investment plans. The services offered are designed to appeal to a younger audience, still new to the field.

The company also offers access to over 600 French shares and ETFs from reputable issuers such as Amundi, iShares (BlackRock) and Xtrackers (DWS).

Trade Republic offers several advantages over other stock brokers, notably in terms of fees, accessibility and ease of use. As Europe’s leading savings platform and broker, Trade Republic has received investments from Accel, Peter Thiel’s Founders Fund, the Ontario Teachers’ Fund, Sequoia and TCV.

These features make Trade Republic an attractive option for those looking to consolidate their banking and investment services in one place, with transparency on fees and ease of use.

Offers and services

The Trade Republic neobank offers a range of banking services, from opening a savings account to making programmed investments free of charge. You can also open securities accounts and make fractional investments. In fact, it is the first stockbroker to do so in Europe.

Before going any further, let’s take a look at some of the services offered by the platform.

Programmed investment

First of all, programmed investment: also known as a regular investment plan or periodic investment, this involves investing a sum of money at regular intervals in financial instruments such as stocks, bonds, mutual funds or ETFs. Rather than investing a large sum of money all at once, a programmed investment allows you to spread your investments over time. In short, programmed investing is a long-term investment strategy that involves regularly investing sums of money in financial instruments, offering various advantages in terms of diversification, risk management and potential returns.

Fractional investment

Fractional investing is also known as stock splitting or fractional investing. It’s a method that allows investors to buy a fraction of a stock rather than the whole share. Traditionally, shares are bought and sold in whole units, which means that investors often have to pay a large sum to buy a single share, especially if the share price is high. Fractional investing makes stocks more accessible to investors by allowing them to buy even small fractions of a share. For example, instead of buying a share in a company priced at €1,000, an investor can buy a fraction of that share for €100. This allows investors to diversify their portfolios with a lower investment amount and participate in stocks with a higher unit price.

To make things even clearer, here’s a table comparing these two types of investment:

| Criteria | Fractional investment | Programmed investment |

| Investment method | Allows the purchase of fractions of shares | Involves regular investment at predefined intervals |

| Investment unit | Fractional shares | Fixed amounts of money |

| Main objective | Make shares more accessible with lower investment amounts | Invest regularly over time to benefit from the effect of compound interest and reduce risk |

| Accessibility | Allows investors to buy expensive stocks with lower investment amounts | Allows investors to start a portfolio with regular investment amounts |

| Diversification | Allows investors to diversify their portfolio with fractional shares of different companies | Allows investors to diversify their portfolio by investing regularly in different assets |

| Flexibility | Offers great flexibility in terms of investment choices, as investors can purchase fractions of different shares | Offers investment discipline and automation for investors wishing to invest regularly |

| Impact of market fluctuations | Sensitive to market fluctuations, as the price of fractional shares can vary | Reduces the impact of market fluctuations, thanks to regular investment over a given period. |

| Example | Buy 1/2 share of a company whose stock costs €1,000 | Invest €100 each month in a mutual fund |

In short, fractional investing allows investors to buy fractions of shares, making stocks more accessible with lower investment amounts. Programmed investing, on the other hand, involves regularly investing fixed amounts in different assets to benefit from the effect of compound interest and reduce risk.

Securities account

A securities account is a type of investment account that enables an individual or entity to buy, sell and hold various types of financial securities, such as stocks, bonds, ETFs, mutual funds, warrants, certificates and so on. In short, a securities account is a versatile investment tool that enables investors to buy, sell and hold a diversified range of financial securities, offering flexibility and growth opportunities. Securities held in a securities account are registered in the name of the account owner. This means that the investor is entitled to ownership of the securities, and can sell or transfer them as required.

Note: Income generated by investments held in a securities account, such as dividends and capital gains, is generally subject to income tax. Tax rates may vary according to the type of income and the tax legislation in force in the investor’s country of residence.

Trade Republic’s broad range of assets (over 10,200 stocks and ETFs) enables users to invest in all markets: American (USA, Canada), European (Germany, UK, Switzerland, France, Holland, Sweden, Italy, Austria, Spain, Finland, Denmark, Norway, Luxembourg, Belgium, Portugal, Poland, Hungary, Greece, Czech Republic, Ukraine, Liechtenstein) and Asian (Japan, China, Hong Kong, Singapore). It is also possible to invest in the Australian market, or in emerging markets (India, Brazil, Bermuda, Indonesia, Mexico, Taiwan), etc.

Mobile app

To make all transactions as quick and easy as possible, the neobank has created an intuitive mobile app. Since January 2024, it has also offered a bank card that allows customers to spend and receive 1% Saveback. Customers can choose a Mirror or Classic card (for an issuing fee of between €5 and €50), or create a Virtual card completely free of charge.

Moreover, users receive real-time notifications of every transaction made with their debit card, enabling them to keep a close eye on their spending and finances.

Bank card

The Trade Republic Visa card combines spending and saving: with Saveback, customers receive a 1% bonus towards their savings plan for every card payment. For example, if you pay €200 with your card, €2 will be invested. For this feature to remain active, however, customers must invest a minimum of €50 per month in a savings plan. What’s more, you can round up your payments and invest the rounded amount in the asset of your choice.

In France, the neobank offers another service: the possibility of opening a PEA.

Trade Republic stands out for its low fees, ease of use and wide range of financial products. Its fixed-fee model and no-fee programmed investments make it an attractive option for small investors and those looking to diversify their portfolios with equities, ETFs and cryptocurrencies.

Position on cryptocurrencies

Trade Republic is positioned as a modern, accessible online broker, particularly suited to younger investors. Its low fees, ease of use and wide range of available assets will also appeal to beginners. The neobank takes a proactive approach to cryptocurrencies, integrating these digital assets into its range of financial products.

This offering allows users to invest directly in cryptocurrencies via the same interface they use for other investments. With the app, it’s possible to trade on the market at any time, on any day and from any location. Users have access to over 50 cryptocurrencies, including Bitcoin, Ethereum, Solana, XRP, Polygon and Fantom.

Trade Republic also allows the purchase of fractions of cryptocurrencies, making these assets accessible even to investors with modest budgets. This encourages greater portfolio diversification for users.

By integrating cryptocurrencies into a user-friendly platform accessible only via a mobile app, Trade Republic makes cryptocurrency investing easier for a broad audience, including novice investors.

The transparent and competitive fee policy applied by Trade Republic, results in the absence of hidden charges on cryptocurrency transactions. This approach boosts user confidence and encourages them to diversify their investments to include cryptocurrencies.

Although the cryptocurrency offering is relatively broad, some users may find that it still lacks certain options compared to dedicated cryptocurrency platforms. Trade Republic focuses primarily on the best-known and most-traded cryptocurrencies.

Integrating cryptocurrencies also means navigating an evolving regulatory landscape. Trade Republic ensures that it adheres to current regulations to maintain compliance and protect investors.

Given the state of the cryptocurrency market at present, Trade Republic may continue to expand its offering. The introduction of additional functionalities for trading these assets is also envisaged. This could include analysis tools and advanced options to meet the needs of more experienced traders.

In this way, Trade Republic is taking a favorable stance towards cryptocurrencies, integrating them into its investment ecosystem while maintaining an approach focused on simplicity and accessibility. This strategy enables a wide range of investors to gain easy access to digital assets, while benefiting from the transparency and low costs associated with the platform.

Features and tools

As previously mentioned, a powerful mobile application and website are available to users and the curious. Trade Republic offers a 100% dematerialized trading experience, with a simple, fluid interface that is particularly attractive to young investors and beginners.

The app, available on the App Store and Google Play, provides more information on assets than competitors, and boasts handy features such as a watch list. It also offers market orders by default, as well as limit and stop-loss orders. Setting minimum and maximum buy and sell prices is easy. Users can manage their investments even when on the move.

Trade Republic allows users to trade stocks and ETFs commission-free, with low brokerage fees. And while Trade Republic’s asset selection is primarily focused on equities and ETFs, they also have access to a diverse range of financial instruments to trade.

In addition, users can count on a secure, encrypted system with sophisticated authentication. With this application, they can easily consult prices in real time, place orders and monitor their portfolios. Finally, Trade Republic offers educational resources and investment information to help users make informed decisions.

These features and tools help make Trade Republic a popular option for investors looking for a simple, affordable online brokerage platform.

Advantages and disadvantages

Advantages

One of Trade Republic’s key advantages is its competitive fees.

There are no fees on dividends received, no fees for inactivity, deposits or withdrawals, making investment more transparent and cost-effective. There are no card fees either.

Opening an account is quick. A securities account can be created in just a few clicks via the application, with no minimum deposit required.

The ability to buy fractions of shares since 2023 enables users to invest even with small budgets. There are many other investment possibilities, even outside market hours. What’s more, customers own their shares, which is not always the case with other stock brokers.

The same is true of programmed investments, which make it possible to gently build up an estate, even for small budgets. It’s possible to invest in assets as little as €1 every week or month via savings plans.

For Trade Republic, security of funds and user data is a priority. The neobank offers the same guarantees as any other European bank, and benefits from the secure framework of the German administration. Customer deposits are guaranteed up to €100,000, providing additional security in the event of bankruptcy. It also uses advanced security protocols to protect transactions and personal information.

Thanks to the app, users receive real-time notifications for every transaction made with their debit card. This enables them to keep an eye on their spending and finances. They can also make free, fast bank transfers from their Trade Republic account to other bank accounts in Europe.

Finally, Trade Republic offers a referral program. Existing users can invite friends to join the platform using a unique referral link. Once the friend registers and fulfills certain conditions (such as making a first deposit or completing a first transaction) both the referrer and the friend can receive a reward. These rewards vary and may include trading credits or other financial benefits. For more details, we recommend consulting the Trade Republic website directly or contacting their customer service department.

Disadvantages

On the other hand, the neobank does not yet offer PEA (outside France) or advanced tools for active trading. Its application lacks technical analysis tools or stock selection criteria.

In addition, Trade Republic uses the “payment for order flow” (PFOF) model, similar to Robinhood, which can sometimes result in less favorable execution prices for investors.

Registration process

Registering with Trade Republic is a quick and easy process, usually carried out via the mobile app. It will normally take a few minutes, but this may vary depending on the speed of identity verification. Trade Republic registration is designed to enable users to start investing quickly after a few simple verification and deposit steps.

Register in less than 10 steps.

First you’ll need to download the Trade Republic app from the App Store (for iOS users) or Google Play Store (for Android users).

Once you’ve downloaded the app, follow these steps to create an account:

1) Open the app and click on “Open an account”,

2) Enter your personal details (first and last name, email address, telephone number and postal address),

3) Choose a secure password to protect your account,

4) Verify your identity by providing documents such as an ID card or passport and proof of address,

N.B.: Trade Republic uses an automated verification procedure or a video call to confirm your identity.

5) Complete a questionnaire about your investment experience, financial goals and risk tolerance,

(This step is mandatory to comply with financial regulations and to tailor our services to your investor profile).

6) Make an initial deposit to activate your account.

This deposit can be made by bank transfer or credit card. Please note that the first card deposit is generally free of charge, but fees may apply for subsequent deposits. Deposit options also include Apple Pay and Google Pay for added convenience.

Once you’ve made your first deposit and your identity has been verified, your account will be activated. You can then start investing in the stock market by buying stocks, ETFs and cryptocurrencies directly via the app.

N.B.: Should you encounter any problems during registration, Trade Republic’s customer service is available to assist new users. Please be patient, as response times can sometimes be a little long in this case.

Customer service

Before contacting support, it may be useful to consult the Help Center on the site or in the application. Many answers to common questions are available there. The platform also provides educational resources, such as articles and tutorials. Investors therefore receive help to better understand the financial markets and make informed decisions.

If the “Help Center” tab on the website doesn’t answer your question, you can contact customer service. There are several ways of doing this, depending on your preferences and the nature of your query.

First, you can contact them via the Trade Republic mobile app, thanks to the integrated Chat. To do this, open the app, access the “Support” or “Help” section and use the integrated chat to chat with a customer service representative.

By email: send an email to Trade Republic’s dedicated customer support address. This address is often support@traderepublic.com or another variant. Check the official website or app for the exact address.

Via the website in the help section. Visit the help section or FAQ on the official Trade Republic website. You’ll often find answers to common questions and the option of contacting support via a contact form.

You can also use social media. Trade Republic can be found on various social networks such as Twitter, Facebook or LinkedIn. You can try contacting them via private messages or by mentioning their official account in a tweet or post.

If necessary, you can also send a letter to Trade Republic’s physical address. This information is usually available on their website in the “Contact” section.

For the most accurate and up-to-date information, feel free to visit Trade Republic‘s official website or their mobile app. All contact options and specific details can be found there.

Trade Republic fees and pricing in 2024

At Trade Republic, fees are very low or non-existent.

For example, you’ll need to pay €1 per buy and/or sell order. There are no fees for programmed investment plans, and no fees for dividends. All cards offer the same advantages, such as free cash withdrawals worldwide. Withdrawals of less than €100 are subject to a €1 fee.

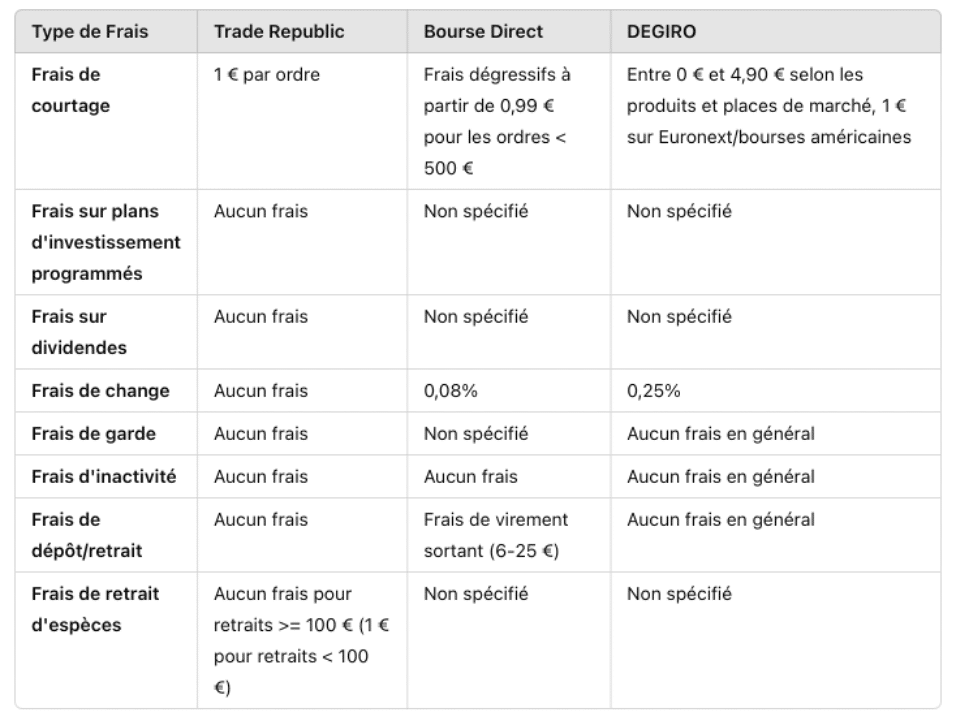

If we compare Trade Republic’s fees with those of two other banks, we obtain the table below:

Trade Republic offers very low, fixed brokerage fees compared with Bourse Direct or DEGIRO. This is advantageous for large orders and investors looking to minimize costs. The neobank offers a simpler and often less expensive fee structure, thanks in particular to the absence of exchange, custody and inactivity fees. Unlike some of its competitors, Trade Republic does not offer margin or options trading.

User opinions and reviews of Trade Republic in 2024

The neobank is relatively well rated on the Trustpilot website, with 3.8/5 for a total of over 18,000 reviews. 70% of users have given it 5 stars, and 83% of reviews are above 3 stars. This rating reflects user satisfaction with the platform, which is encouraging for its future development.

Positive points

Brokerage fees: Trade Republic is often praised for its low brokerage fees. Users particularly appreciate the fixed cost of €1 per order, making investment affordable even for small investors.

Programmed investments: The ability to set up programmed investment plans at no extra cost is a major plus. This is particularly appreciated by those who prefer a passive, regular investment approach.

User interface: Trade Republic’s mobile application is appreciated for its simplicity and clean design. It makes navigation intuitive and investing accessible to a wide audience, especially beginners.

Negative points

Customer support: One of Trade Republic’s main criticisms concerns customer service. Many users complain about the difficulty of getting a quick and efficient response when they encounter problems.

Limited functionalities: Although the offering is sufficient for many, some active investors regret the lack of advanced features and more sophisticated trading options. Trade Republic mainly targets novice investors and those with a passive strategy, which may not be suitable for more experienced traders.

Investment portfolio: Some users find the derivatives offering still limited, despite recent additions. They would like to see greater diversification of available options.

In summary, if users are to be believed, Trade Republic is appreciated for its low fees and functional user interface. In addition, the ability to place orders outside market opening hours is appreciated. This makes the neobank an ideal choice for beginners and passive investors.

However, more advanced users may find the functionality and customer support below their expectations. Negative comments about customer service remain to be monitored to see if the platform has managed to improve this point. It’s worth remembering that customer service is a key issue for a fully dematerialized neobank like Trade Republic. For users, not being able to ask questions or seek advice from a physical person must be compensated for by the platform’s increased responsiveness and ability to respond.

Future prospects and developments

Trade Republic’s development prospects look promising, with several factors contributing to its growth and expansion potential.

Its stock market valuation is a strong point. The neobank is constantly winning over new customers with its competitive prices and varied services. The creation of its own bank card in 2024 should accelerate its development, which is already well underway. The European market represents several hundred million potential users.

Trade Republic’s determination to expand its presence in Europe is clear. Having recently arrived in France, the platform already has plans to enter new markets. This geographic expansion would increase its user base and diversify its revenue streams.

Trade Republic is also banking on product diversification. The neobank has recently added new financial products to its catalog, such as derivatives. Trade Republic plans to continue enriching its offering by introducing more types of investments, which could attract a more varied customer base. The extension of the PEA offer to countries other than France also seems to be a point to keep an eye on.

Trade Republic’s mobile application is at the heart of its offering, so its improvement is an essential point. Frequent updates to the user interface and functionalities should enhance the platform’s attractiveness; particularly for young investors. Taking into account comments and opinions on the application should help to target the modifications to be made.

The focus on programmed and automated investments responds to a growing demand for simplified, passive investment solutions. This could position Trade Republic as a leader in the field of robo-advisors. A robo-advisor is an online investment tool that uses algorithms to build and manage an investment portfolio.

In the years to come, the neobank will certainly face certain challenges. Like all players in the financial sector, Trade Republic must navigate a complex regulatory environment. Complying with the sometimes changing regulations, while keeping fees low, will be crucial to maintaining its success. Its development within the European Union is already pushing it to comply with a plurality of situations in a common market, certainly, but also with many individualities.

The arrival of new players on the market and competition from traditional brokers who are now adapting their offers will push Trade Republic to innovate. Staying competitive in a fast-growing market potentially includes adding new features and improving customer support. If user reviews are anything to go by, this improvement should also enable the neobank to raise its rating, thus attracting new customers.

Trade Republic has recently become profitable, a positive indicator for its financial stability. Previous fund-raising has also provided significant capital to support future growth and strategic initiatives.

To conclude, Trade Republic is in a favorable position to capitalize on current trends in the financial market. The digitization of financial services and the demand for accessible and affordable investment solutions are among the challenges to be met. The neobank’s future will depend on its ability to innovate, adapt to various regulations and expand its product offering and geographical presence.

Our assessment of Trade Republic

Trade Republic has established itself as a major player on the European market with 4 million users and 35 billion euros in assets. Founded in 2015 in Munich, it offers a diverse range of investments (equities, ETFs, cryptocurrencies, bonds, derivatives) with very low fees, attracting mainly first-time and young investors.

The platform offers innovative savings solutions and an intuitive application that has facilitated its expansion into 17 countries. In 2023, Trade Republic obtained a banking license from the ECB, enabling it to further expand its range of investment products. Supervised by financial authorities such as the BaFin in Germany and the AMF in France, Trade Republic ensures a strict and secure regulatory framework for its users.

Among its key features are programmed and fractional investment. These offers make investment accessible even to small budgets. The securities account, meanwhile, lets you manage a wide range of financial securities. A high-performance mobile application and the absence of hidden fees add to the appeal of the platform, which also offers a referral program and multi-channel customer support.

However, some drawbacks remain, such as the lack of advanced tools for active trading and a customer service that is sometimes criticized for its responsiveness. Despite this, Trade Republic is praised for its fee transparency, ease of use and diversification options. It is now a preferred option for novice investors and those looking for passive management. With a rating of 3.8/5 on Trustpilot, the neobank continues to grow and adapt to the needs of its users, consolidating its position in the European online brokerage market.

Whether you’re a beginner or an experienced investor, Trade Republic offers the tools you need to effectively manage your portfolio and achieve your financial goals. The platform will enable anyone without too much knowledge to get started in investing, without shelling out astronomical sums. Advantageous fees and a wide range of investment opportunities, combined with easy-to-use interfaces and security to maximize the customer experience, make Trade Republic a neobank to watch.