Introduction

Bourse Direct is a French online brokerage and trading platform established and founded in 1996. It is regulated by the Autorité des Marchés Financiers (AMF) and the Autorité de Contrôle Prudentiel et de Résolution (ACPR), guaranteeing a secure trading environment for its users. This review looks at its functionality, features, pricing, customer reviews and cryptocurrency offerings.

Key features of Bourse Direct

Bourse Direct offers a range of services aimed at both novice and experienced traders. Key features include:

- Variety of Products: Equities, ETFs, forex and CFDs.

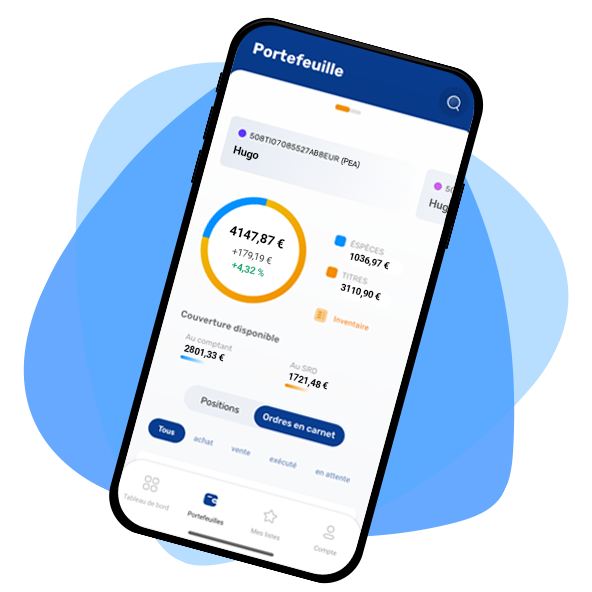

- Platforms: Available on web and mobile platforms.

- Regulation : Fully regulated by the AMF and ACPR.

- Customer Service: Accessible via live chat, telephone and email.

- Demo Account: Available for beginners wishing to practise trading.

How to register with Bourse Direct

Registering with Bourse Direct is easy. Follow these steps to get started:

- Visit the Website: Go to the Bourse Direct website and click on the register button.

- Fill in the Form: Provide your personal information, including name, address and contact details.

- Verify Your Identity: Download the documents required for identity verification.

- Choose Account Type: Select the type of account you wish to open.

- Add to Your Account: Deposit funds by bank transfer or credit card.

How to buy and sell on Bourse Direct

Buying and selling assets on Bourse Direct is easy. Here’s how:

- Log in to Your Account: Access your account via the web or mobile platform.

- Naviguez vers la Section de Trading : Choisissez l’actif que vous souhaitez trader.

- Put in an Order: Select the buy or sell option, enter the amount, and confirm the transaction.

- Follow Your Trades: Track your trades via the platform’s dashboard.

Functionality and User Experience

Bourse Direct offers two main trading platforms: MetaTrader 4 (MT4) and TradeBox. MT4 is widely recognised for its robustness and user-friendly interface, while TradeBox, a rebranded version of FXCM’s Trade Station, offers advanced trading tools and .

Pricing and costs

Bourse Direct’s pricing structure is competitive for French equities but higher for international markets. Here’s an overview:

- Actions Françaises: Fees range from €0.99 to €3.80 depending on the amount of the order.

- International Equities: Higher fees compared to local equities, with US equity trades costing around $10.2 .

- CFD trading: Generally higher costs associated with CFD trading.

Non-trading fees are minimal, with no charges for inactivity or withdrawals. However, only EUR is accepted as a base currency, which may be a limitation for some traders.

Advantages and disadvantages

The benefits:

- Regulated environment: Strong regulatory oversight by the AMF and ACPR.

- Variety of Products: Wide range of trading instruments, including cryptocurrencies.

- No Minimum Deposit: Allows easy entry for new traders.

- Demo Account: Ideal for beginners wanting to train without financial risk.

Disadvantages:

- High Fees for International Transactions: Comparatively higher trading fees for international markets.

- Limited Access to Cryptocurrencies: The platform only offers cryptocurrency ETPs, limiting crypto investments to Bitcoin and Ethereum ETPs.

- Limited Payment Methods: Only bank transfers and credit cards are accepted, no e-wallets.

- Language barrier: Platform and customer service only available in French.

Customer reviews

Customer reviews of Bourse Direct highlight its strong regulatory framework and variety of trading instruments as significant advantages. However, users cited high fees for international transactions and limited payment methods as drawbacks. Overall, the platform is well regarded for its reliability and extensive product offering.

FAQ

- Can I trade cryptocurrencies on Bourse Direct? Yes, Bourse Direct offers cryptocurrency ETPs such as Bitcoin (BTC) and Ethereum (ETH) ETFs.

- Is Bourse Direct regulated? Yes, Bourse Direct is regulated by the Autorité des Marchés Financiers (AMF) and the Autorité de Contrôle Prudentiel et de Résolution (ACPR).

- What are the trading fees? Fees for French shares range from €0.99 to €3.80, while international trades have higher fees. CFD trading costs are also higher.

- What payment methods are accepted? Bourse Direct accepts bank transfers and credit cards, but does not support e-wallets.

- Is there a demo account available? Yes, Bourse Direct offers a demo account for beginners wishing to practise trading.

- In what languages is the platform available? The platform and customer service are only available in French.

Conclusion

Bourse Direct is a robust and reliable online broker with a comprehensive range of trading instruments. Although it offers a secure and regulated trading environment, potential users should take into account the higher fees for international transactions and the language barrier. Overall, it’s a solid choice for those looking to trade the French market and beyond, with a notable focus on cryptocurrencies.