You can now buy Ethereum, the second largest cryptocurrency in the world, with your credit card, VISA or Mastercard. This process is the fastest – it takes a few hours of transactions – but also the most expensive (a commission must be paid).

The other way to buy ethers takes longer – two to three days – but is also cheaper: a bank transfer. You can make transfers through a secure exchange platform before buying your ethers.

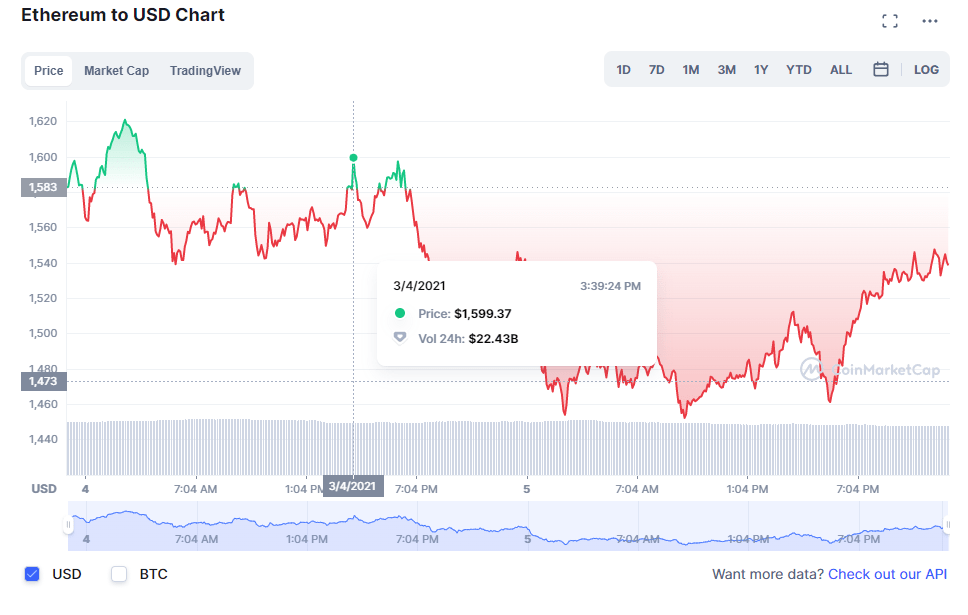

Some figures

Chart of ether/dollar rate

The current price of the ether (ETH)

Even though this value is constantly changing, today 1 ether (ETH) weighs 1,826.19 dollars. It is estimated that there are currently 112,000,000 ethers in circulation. This decentralized cryptocurrency has a capital of over 38 billion euros.

Ether (ETH) Price History

In seven years, ether has become the second largest cryptocurrency in the world. Here’s a look back at how its value has changed over time:

- 2014: The year of its creation, more than 300,000 ETH tokens were raised to fund the project, amounting to $18 million.

- 2015: On July 30, the Ethereum blockchain makes its first big debut, the currency is then worth only a few cents.

- 2016: The price of a token starts at $5 in February and rises to $14 less than a month later, but a hack drops Ethereum to $8 in late April.

- 2017: The currency makes its debut on the Libertex platform, so it goes from $90 to $819.

- 2018: This year is synonymous with ascension, the value of Ethereum climbs to $1396.42 and also quickly falls back below $250.

- 2019: The price remains rather stable, the year starts at $140.82 and rises to $336.75.

- 2020: The Covid-19 makes the value of the currency fall: – 63% in a few days. Its price reaches the same value as at the end of 2018. In July, it is worth $240.

- 2021: There is a sharp rise in ether at the beginning of the year, worth up to $1,813 in mid-February.

Ethereum stock exchange: what determines the ether (ETH) price?

Supply and demand

As with many other cryptocurrencies, Ethereum depends on the market: supply and demand are constantly changing. The price of the ether decreases if demand is lower than supply, it explodes when demand exceeds supply.

As you can see, the price of ether is volatile and uncertain, with the trend sometimes suddenly changing from one day to the next. Several elements come into play and influence supply and demand.

Metcalfe’s law

Metcalfe’s law shows that value increases when the number of users within a network increases. In other words, this empirical law explains that an exchange network involving items or money increases in value according to the number of users.

The popularity rating

The echoes and rumors around this cryptocurrency, however positive they may be, directly influence its price. Thus, social networks remain the number one enemy, or on the contrary, the greatest ally of cryptocurrencies.

What factors influence the value of the ether (ETH)?

Of course, there are several factors that determine and influence the price of the currency. Here are some of them:

Bitcoin

Bitcoin is currently the strongest cryptocurrency on the market. Although Ethereum was not created to be its competitor, today its currency, ether, is. Thus, the price of bitcoin directly affects the value of your ETH tokens. So pay special attention to this currency to assess possible changes in the value of Ethereum.

The country’s tax system

The country’s taxation on stock market capital gains can also swing the trend. Cryptocurrencies are certainly subject to regulations from the countries in which they circulate, but they enjoy a certain freedom.

One of the reasons for these freedoms of circulation is that they are decentralized currencies whose value system is not based on gold or other fiat currencies. However, governments are in a position to regulate these currencies overnight, and thus have an impact on the value of the ether.

Popularity

If the users’ perception of this currency plays a role in its price, the media has a decisive role on the value of Ethereum. As soon as a bug or a flaw is reported by users, the trend can change. Conversely, positive aspects highlighted by users and relayed in the press and social networks contribute to the rise in price.

Ethereum’s future and forecasts

An uncertain future

Ethereum

was invented as a platform of neutral and intelligent contracts facilitating the life and transactions of companies. The usefulness of this blockchain allows us to predict a bright future for it.

On the other hand, it is primarily a cryptocurrency that is traded on the stock market, and estimating its future is rather tricky. Ether is one of the few crypto-currencies among a hundred present on the market to have a strong market capitalization. This explains the volatility of its price. Experts nevertheless predict a strong increase in the value of Ethereum.

Encouraging estimates

We note since 2017 a ratio ETH/BTC which generally weakens. Since the end of 2020, ETH has also been outperforming its direct competitor, the giant Bitcoin. This performance effect, if it intensifies during this 2021, could well allow the ether to outperform bitcoin. If the number of users increases, the value of your tokens could follow the same dynamic.

More and more people are trusting Ethereum, using its protocol and therefore adopting its currency. It is estimated that 1.3% of the world’s population now holds ethers.

Our opinion on Ethereum

You should know that it is never too late to invest in Ethereum. Its currency, the ether (ETH), is very useful as a trading method and has a good future. So all the signs are green to invest. We therefore encourage you to bet on Ethereum for this year 2021. Experts are more than optimistic about it. Even more if you are an entrepreneur, using the Ethereum blockchain and its currency could be profitable for you.

All about Ethereum

Creation of Ethereum

Originally, the cryptocurrency was not the goal of its creator Vitalik Buterin. The 19-year-old programmer created a new process on July 30, 2015, using the Turing Complete language. If he does not add it to the already heavy Bitcoin blockchain, Vitalik Buterin has plans to create Ethereum.

As you can see, the idea of launching a cryptocurrency, ether (ETH), only appears later. Tokens are created in order to remunerate this blockchain project, and it will be necessary to wait until 2016/2017 for the price to take off on the cryptomarket.

Ethereum definition: what is this blockchain?

Ethereum is a platform that allows the creation of decentralized applications, via so-called smart contracts, without intermediaries between users. All professional fields can benefit from these programs and contracts, whether in the real estate, insurance or finance sectors.

The computer code of this blockchain differs entirely from Bitcoin. Thus, Ethereum was not created to compete with Bitcoin, but rather to complement it and expand the possibilities of use and transaction.

How does Ethereum work?

Ethereum works like a supercomputer. The blockchain allows to regulate the payments and these are realized with the associated cryptocurrency, the ether (ETH). In addition, as mentioned briefly, it allows the creation of smart contracts and facilitates exchanges between companies. Like Bitcoin, Ethereum requires no government intervention. This allows a great freedom for users of the blockchain and its attached cryptocurrency.

How the blockchain works

The functioning of the Ethereum blockchain remains basically the same process as for other cryptocurrencies. The transaction of ethers begins with a request for a transaction, followed by the creation of a block (a grouping of a multitude of transactions waiting to be processed). When a valid block is created, it is called mining. When grouped together, the blocks form the blockchain. The processing time of these blocks is an average of 14 seconds.

Mining is therefore an essential part of using your ETH. Each transaction request from a user must be verified, thus put on hold and stored. All these elements are part of the blockchain. Users can access their current transactions through the peer-to-peer network. The peer-to-peer network is a system allowing a network exchange in which the server is also a client. Each member of this network is called a “peer”, “user” or “node”.

How to mine ether (ETH)?

When you make a transaction, it is immediately communicated on the Ethereum network. Then, it is processed by the miners who validate or not the transaction. Thus, the miners group transactions into blocks that will themselves be added to the Ethereum blockchain.

Currently, ether mining follows the Proof of Work protocol: the miner has to find the right hash of the block first. A more ecological, economical and fast method is being studied: the Proof of Stake (a method that consists in proving the ownership of a certain amount of crypto-currencies).

What is mining?

Now you know what blockchain is and how it works. Let’s briefly review the term “mining”, one of the key processes within the blockchain. Mining is a process that allows you to carry out your transactions. Mining is done by multitudes of mathematical equations to solve.

For Ethereum, we mine tokens, not coins. Usually you can’t mine tokens in the “classic” way because these tokens are an integral part of the blockchain. Ether is the currency created by the blockchain which allows, among other things, to pay miners thanks to the transaction fees.

Miners and their tools

Miners use computers that are adapted and designed to do the job. These specific platforms or computers are called mining rigs. This platform allows them to mine much faster and therefore generate more income for the miners. These mining rigs contain multiple graphics cards and processes that operate more or less easily depending on the type of blockchain and transactions.

Another well-known tool for mining is an ASIC (Application-Specific Integrated Circuit). The specificity of the ASIC is that it is designed to perform one or more specific tasks of cryptocurrency mining. On the other hand, this hardware is very expensive and is only compatible with one specific process. Thus it is a big investment for something that could become obsolete if the process changes.

A working internet connection and a device with a lot of computing power allow anyone to mine. However, it is important to note that the calculations required are very complex and the operation is only profitable if you have the right equipment.

The specificity of mining

Mining on the Ethereum network requires the use of powerful graphics cards, mentioned above, usually intended for video games. Mining is also a work of speed: the one who finishes first and validates the transaction will also be the one who adds a new block to the blockchain. It is also important to know that the more miners there are, the more complex the mathematical equations are and the more computing power is required. The computing power allows to process any transaction.

Miners’ remuneration

Mining is a job like any other, paid obviously for its complexity and for the cost of its realization (adapted material, electricity). Validations of operations by miners are rewarded differently depending on the type of transaction and the blockchain used. All transactions performed by miners involve costs for the blockchain users. As previously mentioned, Ethereum miners are compensated through these fees, but also in gas and new ethers created.

The remuneration amount can change from one miner to another. It is therefore delicate to evaluate a fixed and general amount. It depends on the price of electricity in the country where you operate, the tools you use and the current price of the cryptocurrency.

What is the gas ?

The gas is a fictional unit allowing the facilitation payment of the transaction fees of the users. Present in Ethereum, it is used by many other platforms that make smart contracts. The user who makes a transaction pays the fees in ethers, the miner is remunerated in the same way.

This gas only allows to play the intermediary between the user of the blockchain and the one who validates it (the miner). The gas is therefore bought by the ethers when the transaction is validated and makes this virtual machine run by being consumed. The miner who adds a transaction to a block then recovers the ethers used to buy the gas as remuneration.

The cost of gas

L

The amount of money required to transfer ethers between two accounts is always the same: 21,000 gas. The price of gas is defined by a sub-division of ether called Gwei. One Gwei corresponds to one billionth of an ether.

The fixed cost in gas depends on the type of operation and the need for the miners’ calculation operations. This is the case for the elaboration of smart contracts. It should be noted that the price of transaction fees are defined by the user himself. Thus, if we want the miners to select our transaction first to complete it as quickly as possible, the fees must be high. The price of the gas itself will then be increased.

The gas limit

There is a parameter, the gas limit, which corresponds to the maximum amount of gas that the user is willing to use for his transaction. This limit allows the user not to see his ether completely empty and not to create an infinite loop.

Today, several sites offer to help you evaluate the necessary transaction fees depending on the waiting time and the type of transaction to be performed. This will help you set the right price to pay.

What is Ethereum used for?

A network based on blockchain technology, Ethereum is a decentralized platform used to make smart and secure contracts. It offers a virtual currency: the ether (ETH).

The goal of this network is to create DAOs (Decentralized Autonomous Organizations). They are made up of codes allowing the suppression of intermediaries in the blockchain.

Smart contracts

Smart contracts allow, once launched, to automatically execute predefined contract conditions. They work like any other computer code, with if/then operators, etc. The execution speed of these contracts is unmatched. Moreover, since they do not require the intervention of a third party, the cost is low and decreases the costs of verification, fraud, execution…

The reliability and efficiency of these contracts are particularly noteworthy. Indeed, since they are placed in the blockchain, these contracts cannot be modified by one of the parts during the execution.

This of course raises legal and ethical concerns, bypassing the work of lawyers, notaries and others. The government could therefore regulate this aspect of Ethereum. It could turn out to be a direct competitor and threaten certain professions in the (very) long term.

The dApps

dApps are decentralized applications. Similar to a smart contract, a dApp is a platform that connects a service provider and a user through a peer-to-peer network. However, unlike smart contracts, decentralized applications do not impose a limited number of participants. Moreover, they can be of any type and are not limited to strictly financial uses.

Ethereum and its partnerships

A contract was signed at the beginning of the year to allow Reddit to evolve its system thanks to Ethereum tokens. Although this social network remains little known in France, its content is often shared by users of other social networks.

The particularity of this social and community site is that it offers a multiplicity of topics. Reddit thus links news and entertainment. The content is organized into various categories called subreddits. It now has 430 million redditors, or as many potential Ethereum users in the near future. The administrator of Reddit even has the will to create a whole team specialized in blockchain and cryptocurrency.

In May 2020, Reddit introduced its first ERC-20 tokens

- BRICK, dedicated to the video game Fortnite,

- MOON, the official cryptocurrency of the subreddit dedicated to cryptocurrency, r/Cryptocurrency. Using MOONs is restrictive, as they can only be used within the site. Even if this partnership made some people happy, it is not yet clearly completed and developed. This association with Ethereum would nevertheless allow to extend the possibilities of sharing redditors and to multiply the number of Ethereum users. This association is therefore more than beneficial for both companies and its users.

Amazon

As recently as March 3, the giant Amazon partnered with Ethereum. As an agency that manages and facilitates blockchain operations, Amazon Managed Blockchain offers its users the ability to provide nodes and use the open-source Ethereum infrastructure. This alliance comes a month after Jeff Bezos announced that he will step down as CEO in the third half of 2021. His replacement will be Andy Jassy, the current CEO of AWS (Amazon Web Services) who presides over the company’s cryptocurrency offerings.

Amazon Managed Blockchain is in charge of monitoring the nodes, replacing them as needed and updating the Ethereum software to make it easier for customers to use. Customers of this secure network will therefore benefit from the speed and reliability of blockchains created by Ethereum.

Why and how to use ethers (ETH)?

Ethers allow any type of user to be able to buy other crypto-currencies, but also fiat currencies anywhere in the world. Transactions have the benefit of being very secure, fast and low cost. The second largest cryptocurrency in the world, ether (ETH) also allows you to make these smart contracts explained above.

Using ethers is choosing an easy and fast alternative. Moreover, its price is getting more and more valuable. You can therefore invest in Ethereum and ensure a good capital, even from a small amount.

Moreover, sellers are guaranteed to get their payment on the specified date thanks to smart contracts. All the seller has to do is to assign the code attached to the smart contract he has made to ensure the proper receipt of his payment.

What can I buy with ethers?

You can exchange your ethers for money or for other cryptocurrencies. More specifically, it is a payment method to buy goods and services. In short, you can make any transaction you want. So the possibilities are endless, so let your imagination run wild!

Storing your ethers

How to store and secure your ethers ?

Today, there are different methods to secure your ethers. The security and storage methods you choose are linked to different pros and cons. So take all these elements into account to choose the solution that suits you best.

Where to store my ethers ?

Here is a guide to help you choose the best place to store them. Each of these solutions has its pros and cons:

Any exchange platform: level 0 security

If you do not trade, it is advisable to remove your tokens from this platform. It is indeed on these exchange platforms that they are most exposed. The blockchain allows you to guarantee an impeccable security, difficult to hack unless your private key is stolen. When you transfer your ethers on these exchange platforms, you also entrust your key to a less secure network. For example, when you entrust your money to the bank, the bank is paid to enforce regulations and ensure strict security.

On the other hand, the exchange platforms do not ensure this same regulation and therefore the security of your assets. Moreover, hacking has hit many platforms in recent years. Multiple accounts have been hacked and private keys stolen, so a very large number of users have lost their tokens.

That said, exchange platforms remain the most efficient way for direct exchange. Within a few hours, your transaction is completed. To add an extra essential security, make sure to trigger the activation of two-factor authentication. This won’t prevent any hacking, but the procedure will make it more complicated.

A wallet with a private key, itself stored on digital device: level 1 security

You can store your ethers safely and completely eliminate the risk of hacking. You have the possibility to store them in a wallet and to secure your private key more easily. Indeed, your private key is kept on a digital device. You can choose the password of your account and then create a file in which your private key is kept. This way, you are the sole owner of your personal information, but you are also vulnerable to loss and theft.

This secure file can remain on your computer and then be transferred to a USB key to limit losses. Warning: if you lose your private key, you have no way to recover your data. On the other hand, if you lose your password, it is possible to crack your password thanks to a special service. This is a long process with no guarantee.

A “paper wallet”: level 2 security

The paper wallet storage technique is almost identical to the previous one, except for the place where your private key is stored. Indeed, this time your private key is recorded on paper, then printed to be stored in a safe place of your choice: generally in a safe, at home, or in a bank.

However, this alternative has several constraints. You cannot access your tokens regularly and freely. This is a storage option for those who use ethers rather rarely. To reuse your private key, you have to copy it manually and reinsert it into your account to use your ETH.

Thus, this method brings you closer to a flawless security, but you should not loose your papers on which your key is written.

A hardware wallet: level 2 bis security

The hardware wallet is a key that plays the role of a mini-computer and that allows you to generate your private key. Thus, neither your computer nor yourself would have access to this private key. Instead, a key is assigned to you that you can save by copying a sequence of 24 words. This sequence of words should be kept on a piece of paper and put in a safe place. If you lose this key, don’t panic! The 24 words carefully copied by you will allow you to recover it.

When you want to make a transaction and use your tokens, your hardware wallet takes care of everything and signs the transaction. Again, your private key is not involved in the process. Access to your account is done through a secure application and the PIN code you have chosen yourself. Of course, be sure to enter this code out of sight, since the security of your private key and your data depend on it.

Is ether easy to sell?

Yes, ether is easy to sell, but again be careful. There are several steps to take to sell your ether:

- First, you need to create an account on one of the many trading platforms that allow you to buy or sell them. Be sure to keep your password for this account safe and not give it to anyone.

- Then, to sell them for fiat currency, transfer your ETH to that platform.

- Finally, make a transfer to your bank account and withdraw your funds!

These steps are common to all trading platforms. In any case, selling ethers is not rocket science.

What happens if I lose my ethers?

If you lose your security key to access the platforms and wallets that store your ethers, then you will lose them too. On the other hand, your password created on your account can, in certain cases, be saved. The risk of losing them is rather high and multifactorial. This can result in the loss of your wallet PIN code, your security key or even hacking. Even though the Ethereum blockchain is a very secure technology, it is based on smart contracts, so it is not without flaws.

Unfortunately, there is no way to recover lost ethers. So be careful to store and backup your ethers safely and securely.

Many companies and corporations sign contracts with Ethereum in order to optimize their activities. These companies use either the blockchain, its currency the ether, or both.

What is Ethereum 2.0?

The flaws of the current version

As explained earlier, Ethereum is promising but perfectible. Its notable problems at the moment are the low transaction rate and its energy footprint. Indeed, the network can only process about 15 transactions per second. For example, to perform the same operation, Visa performs 2,000 transactions in the same time. Regarding its ecological impact, Ethereum currently consumes about 11.83 TWh per year. There are other, deeper problems that are disrupting the growth of the current version of Ethereum.

The update

To overcome the multiple problems encountered by its users, an update named Ethereum 2.0, or Serenity, was launched. Highly anticipated, this update translates into various technical accommodations and a renunciation of its mechanism of traditional agreements between users. It began in December 2020 and is broken down into three phases: beacon chain, shard chains and eWASM. Here’s a detailed look at these key phases in progress and to be continued:

Setp 1: Beacon Chain

Beginning on December 1, 2020, the first step is a transition between the Proof of Work (mentioned in the explanation of the mining of the blockchain) and the Proof of Stake. Currently under study, the latter will be able to operate in parallel with the old proof of work blockchain in order to avoid breaks in the continuity of chains. If this transition is more than necessary, it is also a long and difficult process that could cause a lot of problems for users if it is not done properly.

Step 2: Shard chains

Step 1 allows the development of shard chains. These shard chains will make the Ethereum network more scalable. Currently, Ethereum is limited to 7-15 transactions per second. This evolution allows to divide data to speed up their processing. More concretely, it consists in sequencing transactions according to their address.

Step 3: EWASM

EWASM (Ethereum Web Assembly) is an execution engine created to replace the Ethereum virtual machine. This engine is designed on Web Assembly. It is an open source web standard for developing applications. The EWASM will improve the performance of Ethereum and support more languages for the development of smart contracts.

The Optimism project

While waiting for the deployment of the Ethereum 2.0 update in its entirety, the Optimism project proposes a temporary solution to ensure scalability. To decongest the blockchain, the use of rollups will allow to validate some transactions externally and to multiply by 100 the number of transactions.